General Insurance Premium Pricing

October 2024 – Outlook for 2024/25

As your dedicated Insurance Adviser, we constantly monitor the insurance market to better understand insurance trends and how they may affect your business.

Having appropriate sums insured for the current replacement value of your assets, stock, contents and machinery is crucial. The cost to rebuild or repair properties and replace items have dramatically increased due to recent impacts of inflation and persistent skilled labour shortages. Adding to the pressure is the persistently lower NZD hovering around US$0.61 cents (October 2024) albeit supply chain issues are starting to improve.

It’s important that we work together to ensure you have the correct valuations and sums insured for your insurance policies. As your Adviser, we recommend that your property and other asset values be reviewed regularly to ensure you’re adequately insured. Having incorrect insured values could result in an adjusted claim due to underinsurance, meaning you are paid less than you need to replace your property. Having a professional valuation can help to prevent this. Our team can arrange access to experienced quantity surveyors who can accurately confirm rebuild costs for commercial and domestic buildings, in addition to plant and machinery.

Pricing Outlook:

The following are some of the key “positives” and “negatives” that will impact insurance premiums over the next 12-18 months.

Positives:

- Improved profitability of Insurers, due to improved investment returns (although lessening overtime as OCR cuts reduce interest rates) and improved profitability in the face of a reduced number of extreme weather events in the last twelve months.

- Those profitable results have enabled improved risk appetites from Insurers as they look to retain existing customers and look for new business growth.

- Having your teams be more cyber-aware in terms of office hygiene, email security, and two-factor authentication certainly reduces your exposure to cyber-crime.

Negatives:

- For New Zealand a neutral weather setting post El Nino does create uncertainty as “anything can happen in neutral conditions – drier, wetter, warmer or cooler” as our location on earth and our mountains and ranges mean we have real variety in our weather week to week. The recent flooding in Dunedin is a clear example of this.

- Reinsurance rates remaining high for Catastrophe Insurance that Insurers purchase due to the ongoing potential of significant weather-related claims and the impact of global events such as North American Hurricanes – the devastating Hurricanes Helene and Milton are very recent examples.

- The lingering effects of inflation and supply issues impacting sums insureds and rebuilding costs coupled with the persistent lower NZD. Taming inflation still remains the core economic challenge driving RBNZ decisions for which insurance premiums are a contributor. Pleasingly, as 2024 progresses, we are seeing inflation fall back into the 1-3% RBNZ target range.

Given the less than expected number of weather-related claims paid and with reinsurance costs overall stabilizing, we are seeing pricing rates and premiums flatten for claims free risks that are not prone to catastrophe peril locations i.e. earthquake. Insurers are focusing on retention of existing clients; looking for growth of new business; and seeking greater market share. Clear evidence of this is Commercial Property premium rates which have flattened for claims free non catastrophe located risks.. Home Building and Contents remains a market suffering losses, and we still expect to see increases of 10%+ depending on dwelling locations and more in high hazard areas. Motor premium costs are steadying, however reliability of offshore vehicles, parts and increasing labour prices see motor premiums continue to be above general inflation levels. In regard to Liability/Professional line classes due to the longer-term improved outlook for investment returns on reserves held for liability classes of insurance, particularly if inflation does continue to moderate, we have seen rates reduce on these classes of business.

With a stabilising market cycle, we anticipate:

- Premium levels flattening and, in some cases, small reductions depending on the class of insurance and risk location .

- Obtaining insurance coverage remains challenging in areas prone to catastrophe risk claims such as earthquake or high flood zones.

- Insurers are increasing capacity on certain low risk occupational risks or industry groups or clients.

- Excesses on policies are stabilising although a small number of Insurers are imposing flood specific excesses or limits in highrisk zones

- Focus remains on risk management and mitigation processes.

- More time and accurate information is still required to place or renew insurance.

- Insurers to look for growth in new business and market share.

Looking to the future

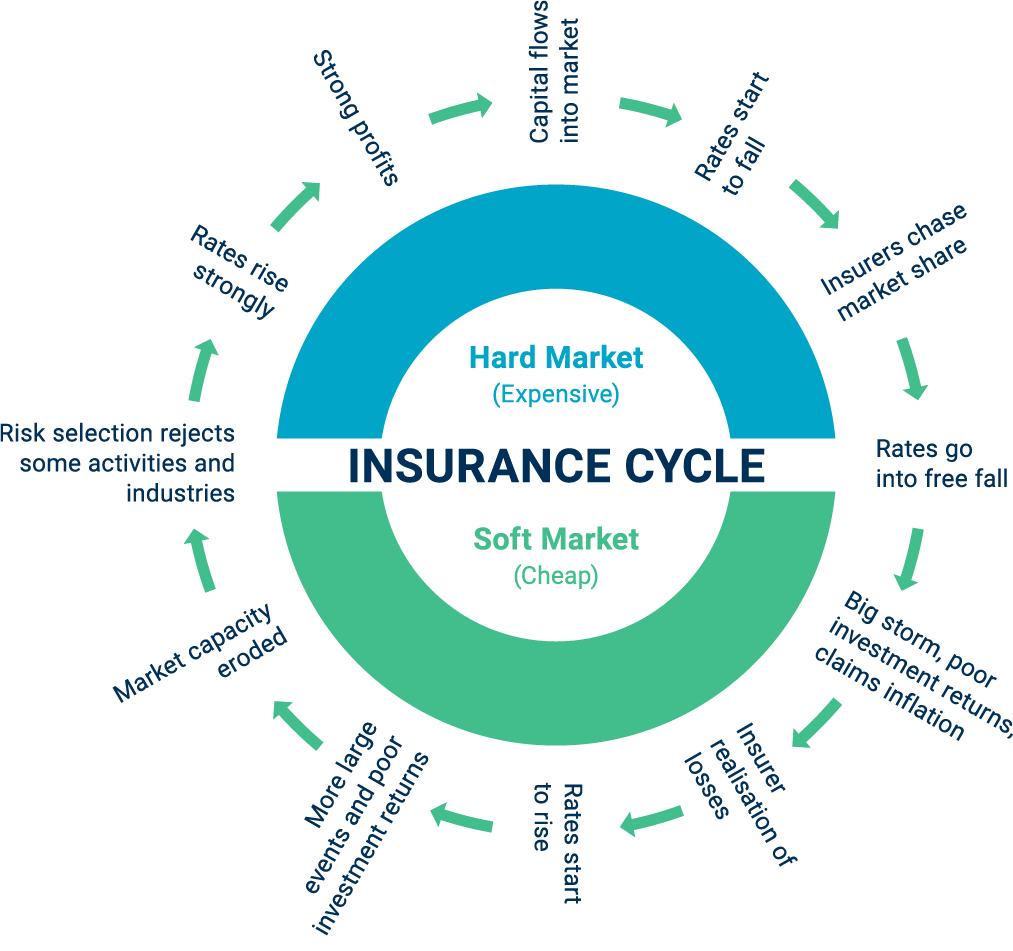

The Insurance Industry, we believe, is sitting at 12 o’clock on the Insurance Clock. Market dominant Insurers announcing strong profits at the end of June 2024 and new capital entering the market earlier this year has amended our outlook over the position of the last 12-18 months. However, the presence and impact of future catastrophic weather events along with economic factors for the rest of 2024 will dictate if the clock’s hands move forward or backwards in the early parts 2025.

Structural change and cost cycles are part of every industry. The Insurance Clock is a useful tool to represent where Insurance rates are now and where they’re likely to be heading in the future.

Should you have any questions or would like to arrange a property and asset valuation or discuss any other general insurance needs, please don’t hesitate to get in touch. We’ll be more than happy to help.